The Gold Report: The Swiss National Bank surprised the world by unpegging the franc from the euro. You wrote that you suspect this will be identified as the beginning of the end and that when the derivatives market blows up, it will take down billions of dollars in hedge funds. Is this the beginning of the end of derivatives and hedge funds or the beginning of the end of something bigger?

Bob Moriarty: The beginning of the end of something bigger. With the Swiss franc tied to the euro, as the dollar went up, the euro went down. This required Switzerland to buy more euros to protect its currency. Switzerland ended up owning nearly as many euros as the country's annual GDP. The Swiss National Bank got out before the European Central Bank (ECB) could increase its quantitative easing (QE).

The real key is the size of the movement. The best record that I've seen indicates a 38% move in the Swiss franc against the euro in 12 minutes. A move that big has never happened before in history.

TGR: Was the size of the movement driven by a kneejerk reaction to the surprise announcement? Later on, it settled out to something lower.

BM: The Bank for International Settlements showed $3.954 trillion ($3.954T) in Swiss derivatives. Somebody was long $4T and somebody was short $4T. As soon as the announcement was made, computer trading kicked in and blew out all of the positions that were short the Swiss franc. Essentially, a trillion dollars disappeared in 12 minutes.

"Almaden Minerals Ltd. has one of the best portfolios filled with wonderful projects and the best management team in Mexico."

Compare that to the 3.25% rise in the U.S. Dollar Index on Jan. 22 and 23. That's a $5.3T day in the currency markets. $1.5T of value disappeared on those two days. These moves are unparalleled in financial history. The swings are getting bigger and far more dangerous.

TGR: Did those Swiss franc trading losses of $1T disappear from hedge funds or was a broader group of people involved? Does it affect economies or just the wealthy banks?

BM: They are all interconnected. The hedge funds borrowed money from a bank and the bank borrowed money from other banks. In the end, this will set up a series of cascading defaults that will take down the entire system. The $700T in derivatives will crater the world's financial system.

For example, commodities firm A has a $100 million ($100M) bet that the Swiss franc is going up. Firm B has a $100M bet that the Swiss is going down. Firm B would have been wiped out by computerized trading. Firm B would go bankrupt because it hadn't anticipated a currency move that big. Meanwhile, the guy at Firm A who's smiling because he just made $30M on his Swiss franc bet goes bankrupt too, because Firm A's money has just been tied up for the next year with the bankruptcy of the trading firm that was holding margin from both funds. Not only did Firm A not get paid the $30M, its $5M in margin has gone into financial limbo for 6 to 12 months.

These enormous wings will bring the financial system down at some point.

TGR: How many more swings of this caliber are needed to start the beginning of the end? Are we on a downward trend?

BM: They've been going on since June of 2007 when the Bear Stearns hedge funds cratered. Since then, it's been one small swing after another small one, after a medium-sized one, after a small one. This is the first really big swing.

All of this is tied in to the dollar and to the change in the value of oil. These things are interrelated. I compare it to a fine 17-jewel watch. When one part breaks, the whole thing breaks.

TGR: Despite these big currency swings, we haven't seen much impact on the banking system. When will that happen?

BM: We have seen an impact. When Mario Draghi, president of the ECB, increased QE in Europe to €1.1T, it was a direct response to the currency swings. Japan did QE. Canada dropped the value of its currency two cents in one day. You could see it in the U.S. dollar, too. It looks to me as if the dollar has topped. If it has, that will have a big impact. All of these things are interrelated.

"Pilot Gold Inc.'s stock should go up nicely."

TGR: What does a drop in the dollar mean for the price of commodities priced in dollars, such as oil and gold?

BM: It should mean prices go up. But we have the highest bull consensus in recorded history on the Dollar Index. Everybody's betting on the dollar going up. When it turns, they get wiped out.

TGR: How fast will that happen? After all, the U.S. economy is growing; people are choosing a flight to safety into the U.S. dollar. Will the U.S. market remain strong through 2015 as this all unravels or are we at that cautionary stage where people pull out and hold their cash?

BM: I'm looking at the chart right now. The Dollar Index went from 92.5 to 95.5 in two days. That hasn't happened in my lifetime.

Currencies are failing. Everybody's in a rush to the bottom and the U.S. dollar is just the cleanest dirty shirt. The fact that the dollar has been going up so much is not a sign of financial health; it's a sign of financial disease. Things go down faster than they go up. Everyone who bet on the dollar and on the S&P 500 is going to end up reversing their positions.

The really big Kahuna is the bond market. When the bond market goes, things will get real interesting.

TGR: What happens when the bond market fails?

BM: When the bond market fails, everything fails. The 30-year Treasury is paying something like 2.75%. That does not reflect a real rate of return after inflation.

The bond markets never last. It doesn't make any difference whose bonds they are, they're never going to be paid off. There will be defaults, probably starting in Greece and cascading throughout the entire system.

TGR: What does that mean for the Eurozone? Will Greece have to leave the European Union (EU)?

BM: Yes, and that would be a good thing. The Greeks are serial bankrupts.

"Red Eagle Mining Corp. has drilled a great project in a friendly country, raised money, spent it wisely and is going into production."

The EU is a failed concept as a currency union. An economic union makes all the sense in the world, but a currency union does not. There is no difference between the Greeks printing a million euros in currency or printing a million euros in bonds. That was a fatal flaw of the system right from the get-go. The Greeks have been borrowing money at the same rate as the Germans. The piper is still playing, but you've got to pay the piper.

TGR: What impact will this have on gold? The gold price jumped up the week of the Swiss announcement, but seems to have stalled. Why isn't gold appreciating?

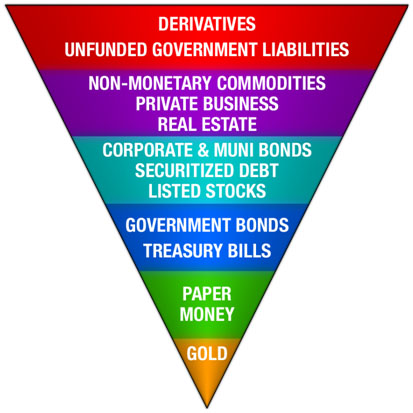

BM: Gold is always the last man standing. John Exter, an economist who worked for the Fed and major banks during the 1960s, had a triangle of resources. He put gold at the very top. When everything else crashed, gold would hold its value.

We forget that in four weeks, gold has gone up $120 per ounce ($120/oz). It's the start of a new bull market. The gold market is healthy. If gold is down today, it's no big deal. Markets go up and markets go down.

TGR: I'm just looking at Exter's chart now, in its inverted form, because we're talking about it going down. It shows derivatives, non-monetary commodities, private business and real estate as being the next areas to depreciate or crash. Then come Muni bonds, securitized debt and listed stocks. Should non-monetary commodities, private businesses and real estate be the next signal?

BM: Yes. The U.S. real estate market has been puffed up by QE. It was hedge funds and speculators who benefited. The higher real estate market was actually a bad sign because it didn't benefit people who actually wanted to live in real houses.

Canada never had a real estate correction and prices there are beyond stupid. Canada's crash will be worse than it was in the U.S. China is slowing down, too.

For most of the base metals—nickel, lead, copper, iron, coal—the worrying bull market is over. Zinc is probably going to go up—there is a shortage of production—so it's okay, but the base metals, iron and coal are probably not good places to be.

TGR: In your article "The Next Big Thing in Silver," you wrote that silver production is determined not only by the price of silver, but also by the price of lead, zinc and copper, because most silver is produced as a byproduct of mining those metals. Given what you just said, should we expect a silver shortage?

BM: People have been predicting a silver shortage for the last 30 years and it's never happened. There are billions of ounces of silver aboveground, which factors into it.

What impacts mining more than anything else is the cost of energy and the cost of iron. When those go down, even though the price of silver or gold stays steady, the reduced costs puts producers in a better financial condition. Miners will be in better condition over the next year because of lower energy costs and the drop in the price of iron.

TGR: You used a company as an example in that article, correct?

BM: Yes, I discussed Defiance Silver Corp. (DEF:TSX.V). The company has either the biggest or second biggest silver mine in Mexico in one of the world's richest silver districts. There is enormous expansion potential. It could easily have 100 to 200 million ounces of silver.

TGR: Are you looking for some reaction in both Defiance's drill results and the price of silver?

BM: Yes. The inputs, such as energy and iron, are important factors. The price of the Mexican peso has decreased 10% in the last month, so Defiance is paying its costs in pesos that are getting less valuable. The cost of energy is going down and silver has gone from $14.50 to $19/oz over the last two months. Defiance's costs go down as the currency it gets paid in goes up.

TGR: When you wrote about Defiance, its largest shareholder was Windermere Capital. That was a real positive for you. Why is that?

BM: Because Defiance has a shareholder that has a vested interest in the price of the shares. Windermere Capital can only make money if the shares go up. That's the kind of company that you want.

TGR: Are you saying that investors should look at the share structure and choose those companies where a non-mining but interested party dominates?

BM: When institutional investors and insider management own 60% or 70%, that tends to be a good thing. It's also important to look at the CEO's salary. The CEO's salary should reflect the real condition of the market. I would look hard at those two things.

TGR: Valentine's Day is coming up, and as Frank Holmes likes to say, gold is the love trade. Which gold companies should investors love right now?

BM: There are some exceptional stories among the well-managed, midtier gold and silver companies. Managements have cut out a lot of fat. The prices are the lowest relative to the price of gold and silver in history. The midtiers will recover first, followed by the juniors.

TGR: Can you give us some examples of companies you love?

BM: I love stocks that go up tenfold. Defiance is one example. It is very cheap. Novo Resources Corp. (NVO:CNSX; NSRPF:OTCQX) will be coming out with a lot of news over the new few months during the Australian summer.

Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE) is one of the best managed mining companies in Mexico. Pilot Gold Inc. (PLG:TSX), True Gold Mining Inc. (TGM:TSX.V), Nevada Sunrise Gold Corp. (NEV:TSX.V) and Gold Canyon Resources Inc. (GCU:TSX.V) are good stocks that have some cash on hand. They all should recover and go up nicely. True Gold has had problems in Africa but Mark O'Dea has stepped in to correct what I see as temporary local issues. He's one of the smartest guys in mining and I think the market has discounted the bad news.

TGR: Almaden has a plan to spin off part of its portfolio to focus on the Ixtaca project. What do you think about that?

BM: It's a brilliant move. One of the problems with project generators, all the way back to NOVAGOLD (NG:TSX; NG:NYSE.MKT), is that you get 95% of your value for your primary project, 5% of your value from your second highest project and you get zero value from all the other projects.

Almaden has one of the best portfolios filled with wonderful projects and the best management team in Mexico. The company is giving these projects to its shareholders for free. In a second company these same projects will have value. Management has postponed the spinoff until June, but it's a great idea.

TGR: Is the postponement an opportunity for investors to get in now and take advantage of that potential spinoff?

BM: Absolutely. Almaden is worth owning just for the spinoff. You essentially get a company with some of the best projects in Mexico for free.

TGR: Let's go into detail about some of the other names you love.

BM: Novo Resources has a Witwatersrand system in Australia that I think will be a homerun.

One of the issues with the Witwatersrand system is that the gold was found in conglomerates. When you have gold in conglomerate layers, similar to coal, you want intercepts as far apart as possible. Novo Resources has drilled four or five kilometers apart and found a 20-meter intercept at 550 meters. I'm very interested in seeing the grade of the 20 meters. If it's Wits grade, I think you can safely assume the gold is continuous from that hole all the way to the surface four or five kilometers away. That would make it a really big project and be a big boost to the stock price. The drill results are expected shortly.

TGR: Tell us more about another of your love stories.

BM: Gold Canyon has a great project, Springpole: 5 Moz in Ontario, Canada. The company has had the most remarkable trading volume that I've ever seen. One big fund started dumping shares in mid-December. I think there are 147M shares outstanding. Close to 70M shares have traded in the last six weeks or so.

TGR: Can you tell who bought the 70M shares? Is it a trend or one or two concentrated investors?

BM: It's very difficult to tell, but it appears someone wants to buy the company.

TGR: Would you tell us about a company you wrote about in December?

BM: Avrupa Minerals Ltd. (AVU:TSX.V). The company will issue more drill results soon. It is a project generator. While most of its projects are in Portugal, it entered a joint venture in Kosovo, where drill results showed 126m of 6 grams per ton (6 g/t). A 6 g/t intercept is nice, but 126m is giant.

TGR: How about some other companies you have been writing about?

BM: There is Red Eagle Mining Corp. (RD:TSX.V). In late October, a big shareholder dumped shares. The stock tumbled from $0.30 to $0.17 in a day. Management was buying the hell out of the stock. I bought some because the price was so stupid.

The stock price has doubled since then and the company is going into production. I love guys who actually do what they say they're going to do. It has great management and a great project.

TGR: If investors missed out from that bounce back to $0.34 a share in November, is there still upside on Red Eagle?

BM: Absolutely. The company is valued at about $22M today. It was worth 50% more than that a year ago. Management has drilled a great project in a friendly country, raised money, spent it wisely and its going into production. It may not be as cheap as it was, but it's still pretty cheap.

TGR: Are there any other gold or silver stocks that are good cheap dates these days?

BM: I think they're all cheap. Here's an example of a stock that's been an utter disaster, but I'm making profit on it. Tembo Gold Corp. (TEM:TSX.V; TBGPF:OTCQX) is in Tanzania, right next to Bulyanhulu. I like the story. I like the area. I've been to the project. I bought at around $1.50/share and had sold the last of my shares at $0.20. Then the price got down to $0.015/share. This is crazy. The company and its deposit are still worth something.

Granted, Tembo has been a disaster for most people, but if you like a stock at $0.50/share you ought to love it at $0.015. Management will have to raise money and get its act together, but the stock has tripled and I'm up 50%.

Too many investors sit on their investments when a stock doubles or triples. Then, when it goes down 99%, they sell. They're always buying at the top. They refuse to take a profit when they can and they sell at the bottom. You have to have a plan. There's a time to sell stocks and there is a time to take profits. People just don't do that.

TGR: Do you have any other sweet nothings to share with our Valentine's Day readers?

BM: The financial system seems to be blowing up day after day after day. You have to stand back and ask yourself, is this normal or is this a sign of something dangerous? I believe it's a sign of something dangerous. People need to be especially conservative.

TGR: Do you mean conservative in investing in resources or conservative in holding a large proportion of cash?

BM: Strangely enough, cash would be a good investment. Gold is the last thing to go, but cash is the second-to-last thing that goes.

The stock market is due for a correction. The dollar is due for a correction. The bond market is exceptionally dangerous.

TGR: Any last tips on how to find the company of your dreams to invest in?

BM: There's no indicator more valuable than the salary of the CEO. The CEO's salary should reflect the real condition of the market. Anybody who invests in any gold or silver junior can go to SEDAR, look at the company's financial report and see what the CEO makes. If it's out of line, don't invest in the company.

I don't expect the CEO of Coeur Mining Inc. (CDM:TSX; CDE:NYSE), Goldcorp Inc. (G:TSX; GG:NYSE) or Newmont Mining Corp. (NEM:NYSE) to get paid $700,000 a year. But if the CEO of 123 Gold R Us is making $700,000, his only interest is keeping enough money in the treasury to pay his salary. His interest is not in the welfare of the shareholders.

TGR: Love your advice and your insights, Bob. Thank you.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Karen Roche conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: Defiance Silver Corp.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Almaden Minerals Ltd., Pilot Gold Inc., NOVAGOLD and Red Eagle Mining Corp. Goldcorp Inc. is not affiliated with Streetwise Reports. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Bob Moriarty: I own, or my family owns, shares of the following companies mentioned in this interview: Novo Resources Corp., Tembo Gold Corp., Almaden Minerals Ltd., Red Eagle Mining Corp., Gold Canyon Resources Inc., Defiance Silver Corp. and Avrupa Minerals Ltd. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Novo Resources Corp., Almaden Minerals Ltd., Red Eagle Mining Corp., True Gold Mining Inc. and Avrupa Minerals Ltd. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.